The Property Tax Process In Ottawa

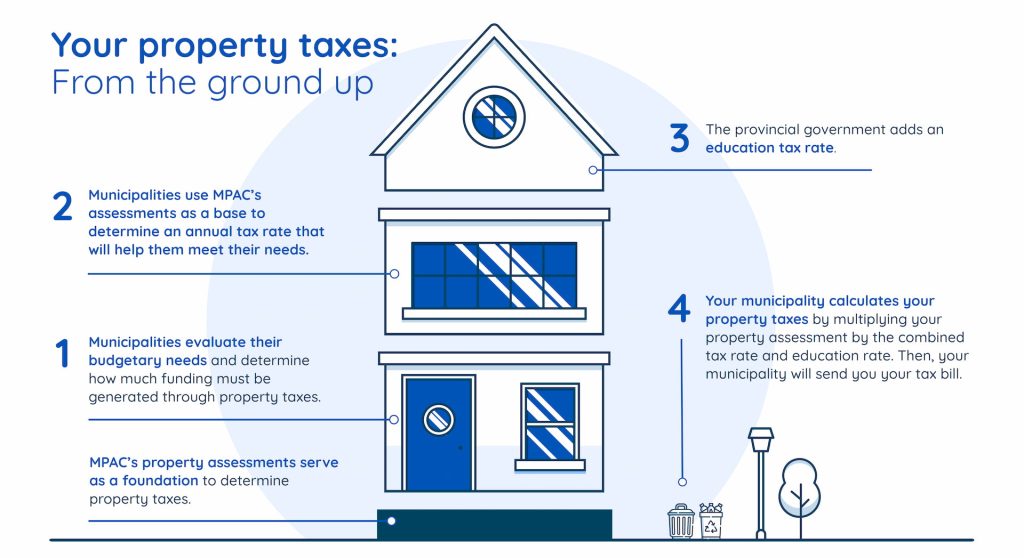

The Ontario Government establishes the provinces assessment and taxation laws and from there, determines the education tax rates.

Your property assessment and property taxes are not the same.

MPAC determines the value of properties each year and sends an assessment notice with this info to the property owners in . Tax authorities then apply a tax rate to the value accordingly and send the owners a tax notice in the Spring. An increase/decrease in your assessment doesn’t necessarily mean an increase/decrease in your property taxes.

The valuation of a property is subject to checks and balances in the form of legislated review and appeal procedures. If you should disagree with your assessment, you can visit the link About My Property and if need be, file a Request for Reconsideration.

Property owners will receive two bills each year, an interim bill which represents 50% of the previous year’s tax bill and a final bill which represents the balance of the year’s taxes. Interim property tax bills are mailed out mid February. The bills are available online at ‘My Service Ottawa’. Payment is due mid March. Final property tax bills are mailed out in May with payments due mid June. To make a payment online, you can login to your account at the link below.

Click on the logo below

Assessed Values:

MPAC (Municipal Property Assessment Corporation) is responsible for assessing and classifying more than five million properties in Ontario. The property assessments they provide are what municipalities use to base the property taxes needed to pay for community services. Municipalities determine revenue requirements, set municipal rates and collect property taxes to pay for municipal services. Property owners pay property taxes that pay for services in the community and pay education taxes that help fund elementary and secondary schools in Ontario.

You can find a wealth of knowledge pertaining to your property assessement by visiting the MPAC website. There is an informative YouTube video at the top of the page explaining How Your Property Tax Is Calculated.

Click on the logo below

Valuation Date:

The Ontario Government sets a new valuation every four years. MPAC then reassesses every property based on the new date. In 2020, the government postponed the 2020 reassessment because of the pandemic, so the last province wide reassessment happened in 2016.

How Does Your Assessment Determine Your Value?

- location of the home

- size of the home

- size of the lot

- age of the home

- miscellaneous features

- comparable sales prices

Information is collected through a comprehensive approach from a variety of sources for accuracy such as: building permits, land titles office, real estate transactions, property owner initiated updates, request sent to property owners, visits to properties, aerial and street front imagery.

The value of your property may have changed if you have:

- renovated recently

- added any new out-buildings to your property

- completed any additions to your home

- finished the basement and/or a secondary suite

Market Values:

Assessed value should be the same as market value, but it seldom is. Tax assessors are basing their values on previous years so it may not align with a rapidly changing market.

Market Value is always changing based on supply and demand. Its important to remember that market value isn’t based on what you will pay or what you value but rather what the buying population is willing to pay.

There are a combination of factors that can determine market value

Comparable Sales (Comps): One of the primary methods used to determine market value is by looking at recent sales of similar properties in the same area. These comparable sales help to establish a baseline value for similar properties.

Location: The location of a property plays a significant role in determining its market value. Factors such as proximity to schools, amenities, transportation hubs, and neighborhood desirability can all affect the value of a property.

Property Characteristics: The size, condition, age, and features of a property also influence its market value. Properties with more bedrooms, bathrooms, and upgrades tend to command higher prices.

Current Market Conditions: Supply and demand dynamics, economic conditions, interest rates, and other market factors can impact the market value of real estate. In a seller’s market where demand exceeds supply, prices tend to be higher, while in a buyer’s market, prices may be lower.

Appraisal: Lenders often require an appraisal to determine the market value of a property before approving a mortgage loan. Appraisers consider factors such as comparable sales, property condition, and market conditions to determine the appraised value.

Investor Perception: Market value can also be influenced by investor perception and market sentiment. Investors may be willing to pay more for a property if they believe it has the potential for future appreciation or if they perceive it to be undervalued.

Zoning and Regulations: Zoning laws, building regulations, and other legal restrictions can impact the value of a property by affecting its potential use and development.

Overall, market value in real estate is a fluid concept influenced by a variety of factors and is often determined through a combination of objective analysis and subjective judgment.

As a seasoned Realtor® I combine personal first hand knowledge of properties in your area, with the market analysis data from the MLS® to compare your property with similar properties that have recently sold. I have years of experience and expertise sided with a solid understanding of the current market conditions and trends which I use to establish the current market value of your home.

If you are thinking of selling, please reach out to me directly to determine the market value of your property at the contact info below.